We are Innovation AVOS Tech

From productivity to cost reduction: how technology can streamline your business operations

Often, the most effective technology is the one you don’t even notice. That’s exactly how many businesses use it in their day-to-day operations.

We’re all familiar with the technologies companies use in customer-facing roles: a chatbot handling enquiries, AI suggesting your next film to watch, or a secure payment gateway processing your online purchases. But fewer people are aware of the technology working behind the scenes, those systems that power the internal workings of a company.

And the scope is vast. To put things into perspective, global investment in SaaS (Software as a Service) tools reached $2.59 billion in 2023, and it’s expected to grow to $5.81 billion by 2030, according to Fortune Business Insights. In Spain alone, the SaaS market was valued at $8.16 billion in 2024, according to Statista.

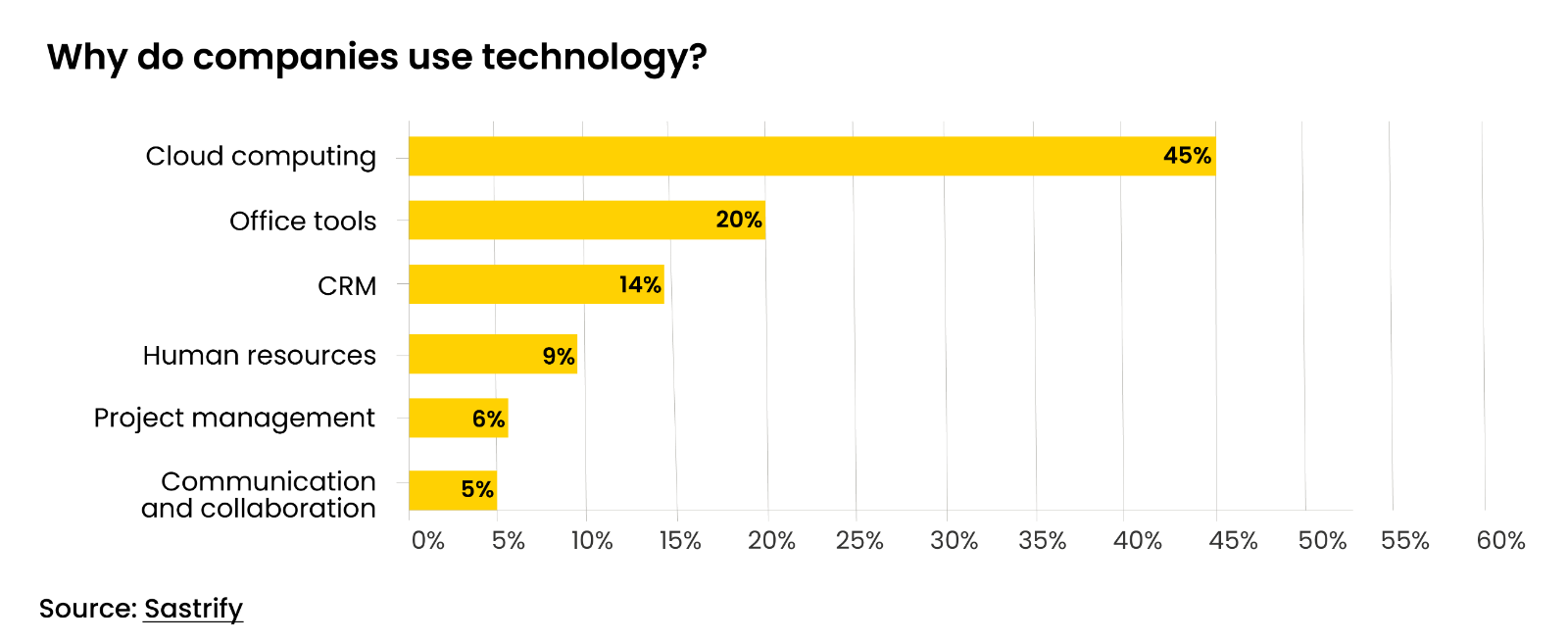

So, how exactly are businesses using these technologies? In short, for just about everything. The 1st European SaaS Investment Report by Sastrify highlights cloud computing as the leading area of focus, closely followed by office tools, CRM systems, HR management, and internal communications.

.png)

Automation, cost reduction, integration…

Among the wide range of technologies worth investing in, AVOS Tech, the business division of Prosegur Group specialising in high-value business process outsourcing and technology integrations, offers several innovative solutions. One of them is ERFcheck, a platform designed to manage large volumes of data. Tailored to the specific needs of each client, it enables the automation of manual tasks, significantly reducing the time and resources required for data handling while enhancing scalability and operational efficiency.

By providing greater oversight of transactions, this technology helps to lower costs and minimise operational losses, thanks to early detection of discrepancies and a reduction in potential errors and fraud. Ultimately, the solution is aimed at boosting productivity by freeing employees from repetitive tasks and allowing them to focus on higher-value activities.

ERFcheck integrates seamlessly with both internal and external systems, offering a wide range of configuration and customisation options. The platform supports multiple file formats and authentication systems.

AVOS Tech’s Technology

AVOS Tech adopts a comprehensive approach, delivering services that combine Business Process Outsourcing (BPO) with advanced technology under a Business Process as a Service (BPaaS) model:

Technology

Back Office BPO

-

Back Office / Mortgage Management

-

Legal Advisory Services

-

Help Desk / Payment Systems / Digital and Remote Banking

-

Cash and ATM Management / Reconciliation

-

Outsourcing of the AML/CFT Technical Unit

Front Office BPO

-

Customer Service

-

Sales and Telemarketing

-

Other services: financial intermediation, B2B appointment setting, and digital tracking

Technology

- SISnet360

- AMLcheck

- ERFcheck

- Other software solutions (CheckRule, Check4Law, SegurSign, ProContactCX, etc.)

- Data Analytics

- Other Services (cloud computing, RPA; Artificial Intelligence, etc.)

The BBVA CIB Spain case

"The solution enables us to quickly identify discrepancies and analyse information in an organised manner. Users’ skillsets are evolving, shifting from a focus on day-to-day operations to placing greater emphasis on oversight and control."

BBVA CIB Engineering

A standout example of ERFcheck’s impact can be seen in its implementation at BBVA CIB Spain. With this solution, the bank transformed a previously fragmented reconciliation process into a centralised and automated system. This evolution enabled the consolidation of over 300 historical reconciliations, improving operational efficiency and reducing both human error and operational risk. The result was a faster, more reliable process aligned with the highest standards of operational excellence.

"We rely on ERFcheck to automatically reconcile the P&L of our financial products," say representatives from BBVA CIB Engineering. "The solution allows us to quickly detect mismatches and analyse information in a structured way. Our users’ skills are evolving, with less focus on manual operations and a greater emphasis on control."

According to Roberto Centeno, Customer Success Manager for Financial Solutions at AVOS Tech, “ERFcheck is positioning itself as an essential tool for companies looking to enhance operational efficiency and reduce risk. Its ability to automate and streamline reconciliation processes makes it a vital solution in today’s business environment.”

With cases like BBVA CIB Spain, “we demonstrate our value and effectiveness, offering businesses a reliable and efficient way to manage their financial operations,” he concludes.

.webp)

.webp)

.webp)