We are Innovation Prosegur Cash

How much cash do we lose by not exchanging currency?

Cash continues to reign supreme in purchases and payments across Spain. That’s why currency exchange remains essential for preserving the value of your money.

Will cash ever disappear? The question comes up time and again, but the answer remains the same: absolutely not. It’s not just about financial inclusion, or the right to pay in whichever way one prefers, or about security, it’s also about user preferences, especially in holiday destinations.

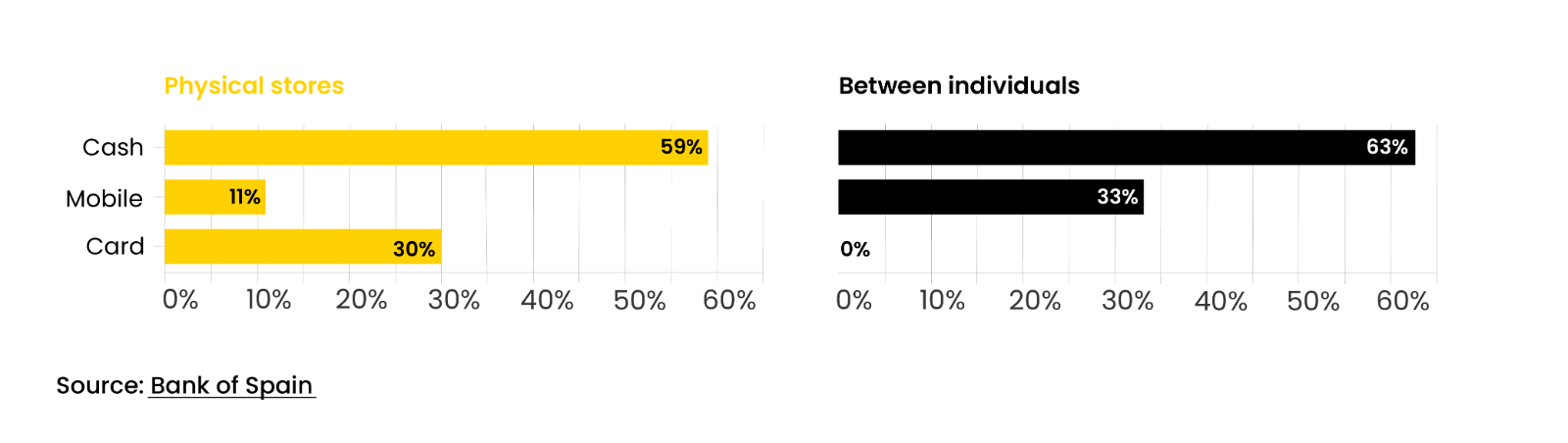

Figures from the Bank of Spain make it clear: although digital payments are clearly growing, 59% of Spaniards still use cash when shopping in physical stores, more than card or mobile payments. Even for person-to-person payments, cash comes out on top (63%) ahead of Bizum (33%).

How do spaniards pay?

.png)

The reign of cash remains clear, and this behaviour becomes even more evident in our holiday destinations within Spain, but even more so when travelling abroad. Having cash in the local currency gives tourists peace of mind when making purchases, knowing it’s a universally accepted payment method in shops, and avoiding technological issues or hidden fees.

It’s also a common reality that after returning from another country, we’re often left with leftover coins or notes, whether out of sentimentality, reluctance if the amount is small, or simply forgetting, resulting in lost money by not going to an office to exchange currency in just a few minutes. For example, in Spain, with the final farewell to the peseta in 2021, Spaniards left the equivalent of €1.5 billion unexchanged.

Currency exchange for over 5 million people in 2024

For those needing to exchange currencies from various countries, Prosegur Cash—through its brands Prosegur Change and Change Group, offers currency exchange services in over 65 currencies.

The company launched this business line a few years ago after integrating Change Group into its team. Change Group operates in 15 countries, including Spain, through a broad network of shops and customer service points. Both under its own brand, Change Group, and through Prosegur Change, it is present in airports such as London Gatwick, Singapore, Copenhagen, and Melbourne, as well as iconic locations like Oxford Street in London, the Champs-Élysées in Paris, Times Square in New York, Puerta del Sol in Madrid, and Las Ramblas in Barcelona. It also operates a dedicated ATM network to support its retail operations.

In 2024, the company served over 5 million customers across its various locations. "We expect to surpass that number in 2025. This growth should come from our expansion into major cities that serve as key origins and destinations for tourist routes. In addition, we’re strongly committed to improving our digital presence," says Sacha Zackariya, CEO of Change Group.

Through the website, customers can reserve the currency they need and either collect it in-store or have it delivered to their home or accommodation. “We are the first company to offer these services while delivering a unique customer experience,” Zackariya adds.

Beyond foreign currency exchange, tourists can also access a range of financial services, including international money transfers, VAT refunds for non-EU residents, and other services such as SIM and eSIM connectivity cards, leisure activity bookings, travel insurance, and more.

"We have a plan to significantly expand our range of products. The first of these are prepaid cards, and over the coming weeks we will introduce more products both in-store and through our digital channels. We’re excited about the new offerings we’ll be bringing to market to better serve our customers. The customer and their experience are our top priority."

Diego Láriz, General Manager of Forex at Prosegur

"Prepaid cards are a great solution for customers who prefer digital payment methods but want to keep fraud risk, which is growing exponentially, under control," Láriz emphasises. The company already offers this service in Australia and New Zealand and plans to roll it out to other countries in the near future.

.webp)

.webp)

.webp)